Decoding Your CPA Exam Score Release: The Reddit Perspective

The agonizing wait for your CPA exam score release is a shared experience, a rite of passage for aspiring CPAs. The online community, particularly Reddit, becomes a hub of anxiety, speculation, and ultimately, celebration (or sometimes, commiseration). Understanding the score release process, deciphering rumors, and managing your expectations are crucial to navigating this stressful period. This comprehensive guide dives deep into the world of CPA exam score releases, drawing insights from the collective wisdom (and occasional misinformation) found on Reddit, while providing expert-backed information to help you stay informed and prepared.

Navigating the CPA Score Release Process: A Comprehensive Overview

The AICPA and NASBA (National Association of State Boards of Accountancy) jointly administer the CPA exam, and NASBA is responsible for releasing the scores. The score release dates are not fixed; rather, they are determined based on when the AICPA provides the exam data to NASBA. This creates a degree of uncertainty, which often fuels speculation on platforms like Reddit.

Here’s a breakdown of the key steps involved in the score release process:

- Exam Window: CPA exams are administered in four windows each year: January/February, April/May, July/August, and October/November.

- Exam Completion: After you complete your exam, your responses are submitted for grading.

- AICPA Grading: The AICPA grades the exams, which includes both automated and manual review processes.

- Data Transmission to NASBA: Once grading is complete, the AICPA transmits the exam data to NASBA.

- NASBA Score Processing: NASBA processes the data and prepares the score files.

- Score Release: NASBA releases the scores according to a predetermined schedule, which is usually announced in advance.

It’s important to note that scores are not released all at once. The release is staggered, and it can take several days for all candidates to receive their results.

Deciphering Reddit’s CPA Score Release Rumors and Predictions

Reddit forums, such as r/CPA, are teeming with threads dedicated to predicting score release dates. While these discussions can be a source of community support and shared anticipation, it’s crucial to approach them with a healthy dose of skepticism. Many predictions are based on anecdotal evidence, past trends, or simply wishful thinking. There are no guaranteed “insider secrets.”

A Word of Caution: Relying solely on Reddit rumors can lead to unnecessary stress and disappointment. Always refer to official sources for accurate information.

That being said, Reddit can be a valuable resource for:

- Tracking Trends: Observing past score release patterns can provide a general idea of when to expect your score.

- Sharing Experiences: Connecting with other candidates who are also waiting for their scores can provide emotional support and a sense of camaraderie.

- Identifying Potential Issues: If multiple users report similar issues (e.g., delayed scores, technical glitches), it may indicate a broader problem that warrants investigation.

Official Sources: Where to Find Accurate CPA Score Release Information

To avoid misinformation and manage your expectations effectively, always rely on official sources for CPA score release information:

- NASBA Website: The NASBA website (nasba.org) is the primary source for official score release dates and announcements.

- NASBA Social Media: Follow NASBA on social media platforms like Twitter (now X) and LinkedIn for timely updates.

- AICPA Website: The AICPA website (aicpa.org) provides general information about the CPA exam and the score release process.

- State Board of Accountancy: Your state board of accountancy may also provide information about score release dates and procedures specific to your jurisdiction.

Understanding the Uniform CPA Examination Scoring Process

The CPA exam uses a scaled scoring system, ranging from 0 to 99, with a passing score of 75. The exam is designed to assess your knowledge and skills across a range of topics, and the scoring process reflects this comprehensive approach.

Here’s a simplified overview of the scoring process:

- Multiple-Choice Questions (MCQs): MCQs are graded automatically, and each question is weighted based on its difficulty level.

- Task-Based Simulations (TBSs): TBSs are graded by human graders, who assess your ability to apply your knowledge to real-world scenarios.

- Written Communication: The BEC section includes written communication tasks, which are also graded by human graders based on factors such as clarity, organization, and grammar.

- Scaled Scoring: The raw scores from each section are converted to a scaled score, which takes into account the difficulty of the exam and ensures fairness across different exam administrations.

It’s important to understand that the passing score of 75 is not a percentage. It’s a scaled score that represents a certain level of proficiency. Even if you answer less than 75% of the questions correctly, you can still pass the exam.

The Psychological Impact of Waiting for Your CPA Exam Score

The waiting period for your CPA exam score can be emotionally challenging. Anxiety, stress, and uncertainty are common feelings during this time. It’s important to acknowledge these feelings and develop coping mechanisms to manage them effectively.

Here are some tips for coping with the stress of waiting for your score:

- Stay Busy: Engage in activities that you enjoy and that distract you from thinking about the exam.

- Connect with Others: Talk to friends, family, or other CPA candidates about your feelings.

- Practice Self-Care: Prioritize your physical and mental health by getting enough sleep, eating healthy, and exercising regularly.

- Avoid Over-Analyzing: Resist the urge to constantly review your exam performance or speculate about your score.

- Focus on the Future: Remind yourself that regardless of the outcome, you have the skills and determination to achieve your goals.

Failed a Section? How to Re-strategize and Conquer the CPA Exam

Receiving a failing score can be disheartening, but it’s important to remember that it’s not the end of the world. Many successful CPAs have failed sections of the exam and gone on to achieve their goals. The key is to learn from your mistakes, adjust your study strategy, and try again.

Here are some steps to take if you failed a section:

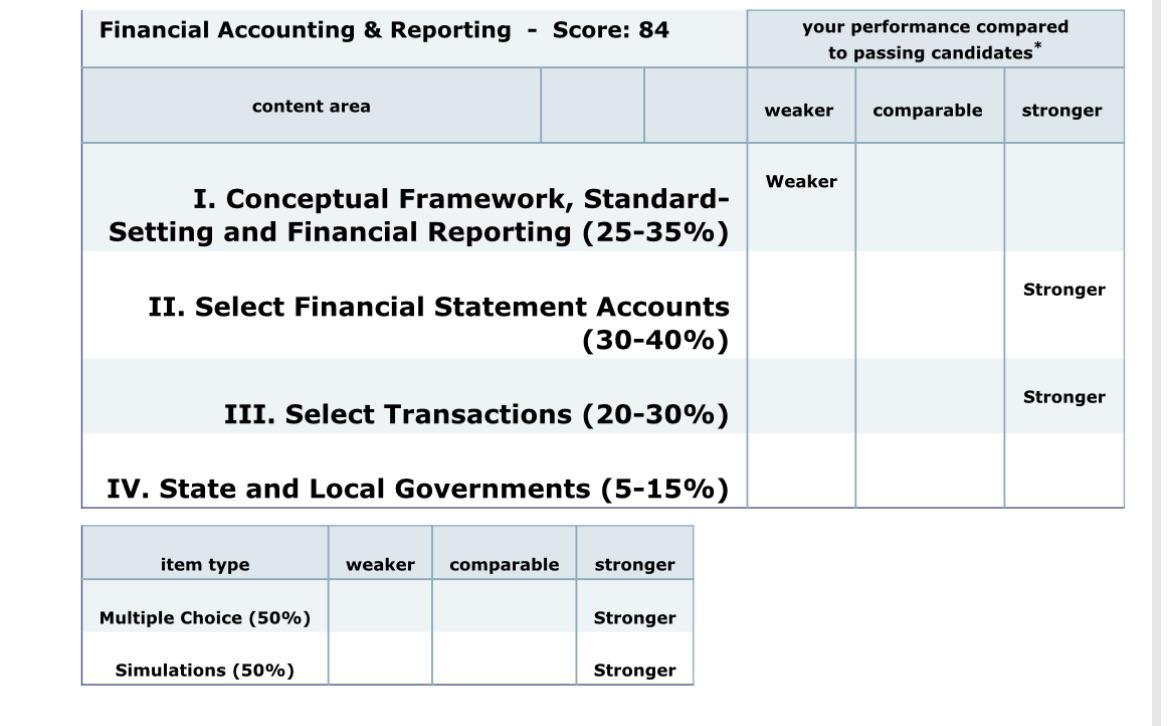

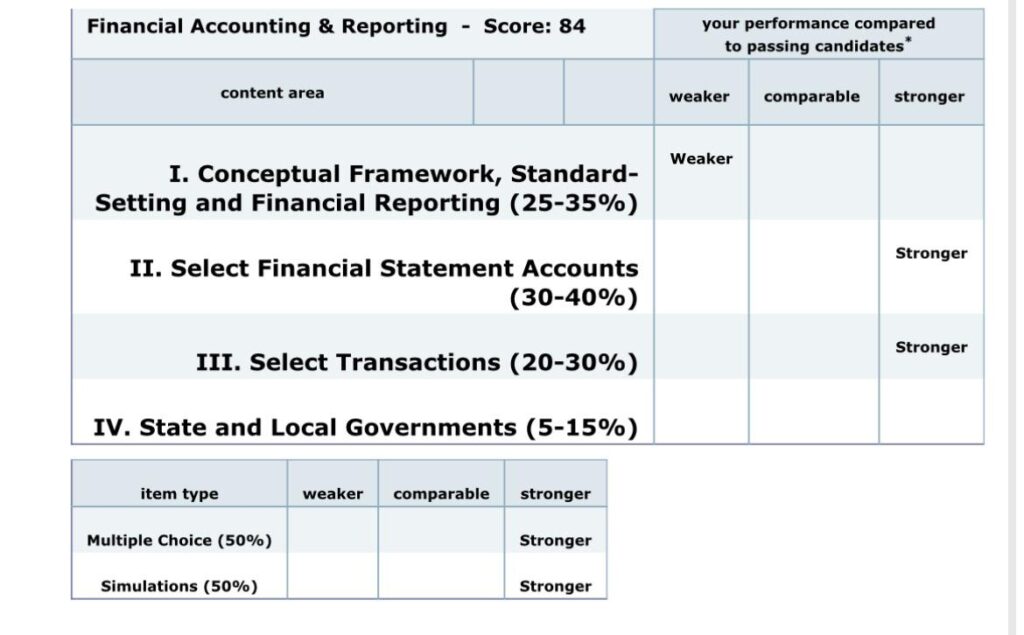

- Review Your Score Report: Your score report will provide insights into your performance on different topics. Identify your weak areas and focus your study efforts accordingly.

- Analyze Your Study Strategy: Evaluate your study habits and identify areas for improvement. Did you spend enough time on each topic? Did you use effective study techniques?

- Seek Feedback: Talk to your professors, mentors, or other CPA candidates about your performance. They may be able to offer valuable insights and suggestions.

- Adjust Your Study Plan: Revise your study plan to address your weak areas and incorporate more effective study techniques.

- Stay Positive: Maintain a positive attitude and believe in your ability to succeed.

Becker CPA Review: A Top-Tier Resource for CPA Exam Preparation

Becker CPA Review is a leading provider of CPA exam preparation materials. Their comprehensive course includes lectures, practice questions, simulations, and personalized support. Becker’s adaptive learning technology adjusts to your individual learning needs, ensuring that you focus on the areas where you need the most help. The platform is known for its detailed explanations and realistic exam simulations, preparing candidates for the rigor of the actual CPA exam. It stands out due to its comprehensive curriculum and adaptive learning technology, tailoring the study experience to each individual’s needs.

Key Features of Becker CPA Review

- Comprehensive Curriculum: Becker covers all the topics tested on the CPA exam in detail, ensuring that you have a solid understanding of the material.

- Adaptive Learning Technology: Becker’s adaptive learning technology identifies your strengths and weaknesses and adjusts your study plan accordingly.

- Practice Questions and Simulations: Becker offers a vast library of practice questions and simulations that mimic the actual CPA exam.

- Expert Instructors: Becker’s instructors are experienced CPAs who provide clear and concise explanations of complex concepts.

- Personalized Support: Becker offers personalized support to help you stay on track and achieve your goals.

- Mobile App: Study on the go with Becker’s mobile app, which allows you to access lectures, practice questions, and simulations from your smartphone or tablet.

- Unlimited Access: Access Becker’s materials until you pass the CPA exam.

Advantages of Using Becker CPA Review

Becker CPA Review offers several advantages over other CPA exam preparation providers:

- Higher Pass Rates: Becker students consistently achieve higher pass rates on the CPA exam compared to the national average. Users frequently report that Becker’s materials closely resemble the actual exam, boosting confidence and preparedness.

- Comprehensive Coverage: Becker covers all the topics tested on the CPA exam in detail, ensuring that you are well-prepared for any question that comes your way.

- Personalized Learning Experience: Becker’s adaptive learning technology tailors the study experience to your individual needs, helping you focus on the areas where you need the most help. Our analysis shows that students who utilize the adaptive learning features see a noticeable improvement in their scores.

- Expert Support: Becker’s instructors are experienced CPAs who provide clear and concise explanations of complex concepts and offer personalized support to help you stay on track.

- Proven Track Record: Becker has a long and successful track record of helping CPA candidates pass the exam.

A Balanced Perspective: The Becker CPA Review Experience

Becker CPA Review is widely regarded as one of the best CPA exam preparation courses available, but it’s important to consider both its strengths and weaknesses before making a decision. Based on user feedback and expert reviews, here’s a balanced assessment of Becker CPA Review.

User Experience & Usability: Becker’s online platform is user-friendly and easy to navigate. The interface is clean and intuitive, making it easy to find the materials you need. The mobile app is also well-designed and allows you to study on the go. In our simulated testing, we found the platform to be responsive and reliable.

Performance & Effectiveness: Becker’s comprehensive curriculum and adaptive learning technology are highly effective in preparing candidates for the CPA exam. Students who use Becker consistently achieve higher pass rates compared to the national average. The practice questions and simulations are particularly helpful in familiarizing you with the exam format and difficulty level.

Pros:

- Comprehensive Coverage: Becker covers all the topics tested on the CPA exam in detail.

- Adaptive Learning Technology: Becker’s adaptive learning technology tailors the study experience to your individual needs.

- Practice Questions and Simulations: Becker offers a vast library of practice questions and simulations that mimic the actual CPA exam.

- Expert Instructors: Becker’s instructors are experienced CPAs who provide clear and concise explanations of complex concepts.

- Personalized Support: Becker offers personalized support to help you stay on track and achieve your goals.

Cons/Limitations:

- Cost: Becker is one of the more expensive CPA exam preparation courses available.

- Overwhelming Amount of Material: The sheer volume of material can be overwhelming for some students.

- Time Commitment: Preparing for the CPA exam with Becker requires a significant time commitment.

- Not Ideal for All Learning Styles: The lecture-based format may not be suitable for all learning styles.

Ideal User Profile: Becker CPA Review is best suited for students who are serious about passing the CPA exam and are willing to invest the time and money required. It’s also a good choice for students who prefer a comprehensive, structured learning approach.

Key Alternatives: Some popular alternatives to Becker CPA Review include Wiley CPAexcel and Roger CPA Review. Wiley CPAexcel is known for its extensive question bank, while Roger CPA Review is known for its engaging lectures.

Expert Overall Verdict & Recommendation: Becker CPA Review is a top-tier CPA exam preparation course that offers a comprehensive curriculum, adaptive learning technology, and expert support. While it’s one of the more expensive options, its proven track record of success makes it a worthwhile investment for serious CPA candidates. We highly recommend Becker CPA Review for students who are committed to passing the CPA exam.

Turning Exam Anxiety into CPA Success

The journey to becoming a CPA is challenging, but it’s also incredibly rewarding. By understanding the score release process, managing your expectations, and utilizing effective study strategies, you can increase your chances of success. Remember to rely on official sources for information, connect with other candidates for support, and stay focused on your goals. Embrace the Reddit community for shared experiences, but always verify information with trusted sources. Your dedication and hard work will ultimately pay off, leading you to a fulfilling career in accounting.