Understanding Future Care Premium Increases in May 2025: A Comprehensive Guide

Are you concerned about potential increases in your future care premiums, particularly as we approach May 2025? You’re not alone. Many individuals and families are grappling with the complexities of long-term care planning and the associated costs. This comprehensive guide aims to provide clarity and actionable insights into the factors influencing future care premium adjustments, empowering you to make informed decisions about your long-term financial security. We delve into the key drivers behind these potential increases, explore strategies for mitigating their impact, and offer expert perspectives to help you navigate the evolving landscape of long-term care insurance.

Decoding the Landscape of Future Care Premiums

Future care premiums represent the ongoing costs associated with long-term care insurance policies. These premiums are designed to cover the expenses of various care services, including in-home assistance, assisted living facilities, and nursing home care. Understanding the factors that influence these premiums is crucial for effective financial planning.

Several elements contribute to the fluctuations in future care premiums. These include:

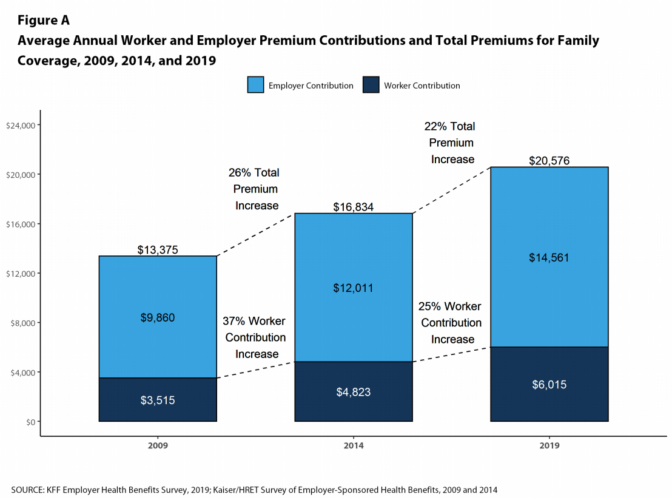

- Changes in Healthcare Costs: The rising cost of healthcare services, including labor, medication, and equipment, directly impacts the expenses incurred by long-term care providers. These increased costs are often passed on to policyholders through premium adjustments.

- Actuarial Projections: Insurance companies rely on actuarial projections to estimate future claims and set premium rates. These projections take into account factors such as mortality rates, morbidity rates (the prevalence of disease), and the likelihood of policyholders requiring long-term care services. If actuarial projections indicate a higher risk or increased costs, premiums may be adjusted accordingly.

- Interest Rates: Interest rates play a significant role in the financial performance of insurance companies. When interest rates are low, insurers may need to increase premiums to maintain their profitability and ensure they have sufficient funds to cover future claims.

- Regulatory Changes: Government regulations and policies can also influence long-term care premiums. Changes in regulations related to healthcare reimbursement, care standards, or insurance industry practices can impact the costs incurred by insurers and subsequently affect premium rates.

Furthermore, the specific terms and conditions of your long-term care insurance policy, such as the benefit period, elimination period, and coverage limits, can also affect your premium costs. Policies with more generous benefits or shorter elimination periods typically come with higher premiums.

The Significance of May 2025

The specific mention of May 2025 likely points to a scheduled review or adjustment period for many long-term care insurance policies. Insurers often conduct periodic reviews of their premium rates to ensure they accurately reflect the current risk environment and cost trends. May 2025 could be a date by which new actuarial data is incorporated, or when broader economic factors are re-evaluated, leading to widespread premium adjustments across the industry. It is essential to understand that the exact reasons may vary depending on the insurance provider and the specifics of your policy.

A Deep Dive into Long-Term Care Insurance Policies

Long-term care insurance policies are designed to protect individuals from the potentially devastating financial burden of needing extended care services. These policies typically cover a range of services, including:

- Home Healthcare: Assistance with activities of daily living (ADLs), such as bathing, dressing, and eating, provided in the policyholder’s home.

- Assisted Living Facilities: Care and housing in a community setting for individuals who require assistance with ADLs but do not need the level of care provided in a nursing home.

- Nursing Home Care: Skilled nursing and medical care provided in a licensed nursing facility for individuals with significant health needs.

- Adult Day Care: Supervised care and social activities provided in a community setting for adults who need assistance during the day.

The benefits provided by a long-term care insurance policy are typically subject to certain limitations and restrictions. These may include:

- Benefit Period: The maximum length of time that benefits will be paid.

- Elimination Period: The number of days that the policyholder must pay for care services out of pocket before benefits begin.

- Daily Benefit Amount: The maximum amount that the policy will pay for care services each day.

- Lifetime Maximum Benefit: The total amount of benefits that the policy will pay over the policyholder’s lifetime.

Navigating Premium Increases: Strategies and Considerations

While future care premium increases can be concerning, there are strategies you can employ to mitigate their impact:

- Review Your Policy: Carefully review your long-term care insurance policy to understand the terms and conditions related to premium adjustments. Pay attention to any provisions that allow the insurer to increase premiums and the factors that trigger such increases.

- Contact Your Insurer: Reach out to your insurance company to inquire about potential premium increases and the reasons behind them. Ask for clarification on any aspects of your policy that you don’t fully understand.

- Explore Alternative Options: If you are facing a significant premium increase, consider exploring alternative options, such as reducing your coverage benefits, shortening your benefit period, or increasing your elimination period. These changes can help lower your premium costs while still providing you with valuable long-term care protection.

- Shop Around: Compare long-term care insurance policies from different insurers to see if you can find a more affordable option with comparable coverage. Keep in mind that premium rates can vary significantly between insurers, so it’s worth doing your research.

- Consider a Hybrid Policy: Hybrid long-term care insurance policies combine life insurance or annuity features with long-term care benefits. These policies often offer more predictable premiums and can provide a death benefit if long-term care services are not needed.

The Role of Actuarial Science in Premium Setting

Actuarial science is the backbone of insurance pricing. Actuaries use sophisticated statistical models to predict future events, such as mortality, morbidity, and healthcare costs. These predictions are essential for setting premium rates that are both affordable for policyholders and sustainable for insurance companies. The accuracy of these predictions directly impacts the stability of long-term care insurance premiums. If actuaries underestimate the rate of healthcare cost inflation or the likelihood of policyholders needing long-term care, insurers may need to increase premiums to cover their expenses.

Actuarial models are constantly being refined and updated to reflect the latest data and trends. As healthcare costs continue to rise and the population ages, actuaries face the challenge of accurately predicting the future costs of long-term care. This challenge is further complicated by factors such as advances in medical technology, changes in government regulations, and the increasing prevalence of chronic diseases.

Expert Insights on Long-Term Care Planning

Planning for long-term care is a complex process that requires careful consideration of your financial situation, health status, and personal preferences. Seeking guidance from a qualified financial advisor or elder care planning professional can be invaluable. These experts can help you assess your long-term care needs, evaluate your insurance options, and develop a comprehensive financial plan that addresses your specific circumstances.

According to leading experts in the field, it’s crucial to start planning for long-term care as early as possible. The younger and healthier you are, the more affordable your insurance premiums will be. Additionally, planning ahead allows you to make informed decisions and avoid being forced into hasty choices during a crisis.

It’s also important to consider your family’s history of health conditions and longevity. If you have a family history of Alzheimer’s disease, Parkinson’s disease, or other conditions that may require long-term care, you may want to consider purchasing a more comprehensive insurance policy with higher benefit limits.

The Impact of Inflation on Future Care Costs

Inflation is a significant factor that can erode the value of your long-term care insurance benefits over time. As healthcare costs rise due to inflation, the daily benefit amount provided by your policy may not be sufficient to cover the full cost of care services. To protect yourself from the impact of inflation, consider purchasing a policy with an inflation protection rider. This rider will automatically increase your daily benefit amount each year to keep pace with rising healthcare costs.

There are typically two types of inflation protection riders: simple inflation and compound inflation. Simple inflation increases your benefit amount by a fixed percentage each year, while compound inflation increases your benefit amount by a percentage that compounds annually. Compound inflation provides greater protection against inflation over the long term, but it also comes with a higher premium cost.

Understanding Policy Riders and Options

Long-term care insurance policies often come with a variety of riders and options that can customize your coverage to meet your specific needs. Some common riders include:

- Return of Premium Rider: This rider provides a refund of a portion of your premiums if you cancel your policy or if you die without using the long-term care benefits.

- Nonforfeiture Rider: This rider provides a reduced benefit if you cancel your policy after a certain number of years.

- Shared Care Rider: This rider allows you and your spouse to share your policy benefits, providing greater flexibility and coverage.

- Restoration of Benefits Rider: This rider restores your policy benefits to their original level if you exhaust them and then recover.

When choosing riders and options, it’s important to carefully consider your individual needs and circumstances. A qualified financial advisor can help you evaluate the pros and cons of different riders and options and determine which ones are right for you.

Long-Term Care Insurance Alternatives

While long-term care insurance is a valuable tool for protecting against the financial risks of needing extended care services, it’s not the only option available. Other alternatives include:

- Self-Funding: Saving enough money to cover the cost of long-term care out of your own pocket. This option may be suitable for individuals with significant financial resources.

- Medicaid: A government-funded healthcare program that provides coverage for low-income individuals and families. Medicaid may cover long-term care services, but eligibility requirements are strict.

- Life Insurance with a Long-Term Care Rider: Some life insurance policies offer a long-term care rider that allows you to access a portion of your death benefit to pay for long-term care expenses.

- Annuities with a Long-Term Care Feature: Some annuities offer a long-term care feature that provides additional income to pay for long-term care expenses.

The best approach to long-term care planning depends on your individual circumstances and financial situation. A comprehensive financial plan should take into account your assets, income, health status, and personal preferences.

Reviewing Genworth’s Cost of Care Survey

The Genworth Cost of Care Survey is an invaluable resource for understanding the current and projected costs of long-term care services across the United States. The survey provides detailed information on the median costs of various care settings, including home healthcare, assisted living facilities, and nursing homes. Reviewing this survey can help you get a realistic estimate of the potential costs you may face and inform your long-term care planning decisions.

What to Expect in 2025 and Beyond

As we approach May 2025, it’s prudent to proactively address potential premium adjustments. This involves staying informed, reviewing your policy details, and exploring strategies to mitigate the impact of any increases. The long-term care landscape is constantly evolving, and staying abreast of industry trends and expert insights is crucial for making informed decisions.

Long-term care planning is an ongoing process, not a one-time event. Regularly review your financial plan, insurance coverage, and care preferences to ensure they align with your changing needs and circumstances. By taking a proactive and informed approach, you can protect your financial security and ensure you have access to the care you need in the future.

If you have questions or concerns about your long-term care insurance policy or future care premiums, don’t hesitate to contact your insurance company or a qualified financial advisor. They can provide personalized guidance and help you navigate the complexities of long-term care planning.

Securing Your Future: Long-Term Care Planning Essentials

Understanding and preparing for potential increases in future care premiums, especially as we approach May 2025, is a critical component of responsible long-term care planning. By understanding the factors that influence premium adjustments, exploring strategies for mitigating their impact, and seeking expert guidance, you can take control of your financial future and ensure you have access to the care you need when you need it most. Share your thoughts and experiences regarding long-term care planning in the comments below to help others make informed decisions.